By Thane Tennison, BDX Senior Advertising Manager

By Thane Tennison, BDX Senior Advertising Manager

As a publisher, I work with hundreds of different builders and agencies all trying to gain a competitive edge in the online space. Sometimes that edge is obvious like adjusting creative to improve Click Through Rate (CTR) and drive lower Cost Per Clicks (CPCs). Sometimes, it’s less revealing like understanding which channel yields better conversions and ultimately a lower $/lead regardless of the upfront spend.

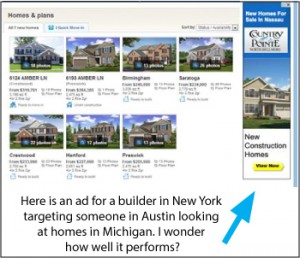

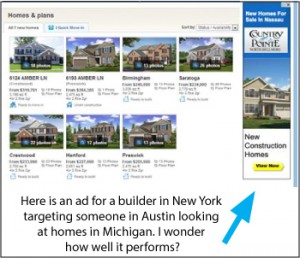

Oftentimes agencies ask, “Why should I buy display advertising from you when I can get it from Google?” It’s a legitimate question, Google and other Ad Exchanges provide a wealth of sites and a range of products from paid search and “contextually relevant” placement to keyword targeting and a seemingly attractive pricing model for Pay Per Click.

If I were a marketing team looking to drive traffic at the very top of the funnel display, an exchange like Google might make sense. However, for a more targeted media placement I often find that a direct buy has significant advantages.

PREMIUM PLACEMENT:

The main difference between a direct buy and a remnant network exchange is just that – it is remnant inventory. Publishers with direct clients are incentivized to provide the best placements for optimal performance and there are a number of tools at their disposal to help optimize the campaign. Publishers can optimize a buy by booking premium positions, managing ad priorities, frequency capping, day parting etc.

The exchange networks simply look at impressions available as well as the yield opportunity that your ad will get clicked vs. another ad in their network. This means if you’re not constantly managing your bid, keywords and testing new creative you could be at a significant disadvantage. At the BDX we have insights into creative that works and creative that doesn’t. A few times a month we help a builder achieve 4x lift in click thru just by making adjustments to the art. With exchanges, the art would run as is and you might find that you’re having to pay more for that click since the exchange is going to need to serve more impressions to secure that revenue. A low CTR not only means you may pay more per click but you’re also competing against the yield they can make from every other advertiser competing for that customer.

TARGETING:

Networks have limitations in their targeting abilities by relying on keywords and the contextual relevancy of the website. However in real estate – especially new home construction – these networks alienate about 50% of the home shoppers who are relocating into a market. If I’m a local builder in Austin advertising on Google targeting real estate websites I’ll reach consumers in Austin but I won’t reach consumers moving from Dallas, Houston, L.A., Chicago or D.C. into the Austin market.

We recently ran an analysis of traffic by market and the results are clear; traffic on a market level works in concentric circles. In Austin, about 50% of the traffic is within market (people moving from one side of town to the other) another 30% of the traffic is from neighboring cities (i.e. Dallas, San Antonio, Houston) and 20% from consumers outside of Texas. In Texas, these markets are hundreds of miles apart and if I’m a local builder I have zero brand equity with a consumer from Dallas or Houston and much less from someone moving from Atlanta or LA.

What was even more interesting is when we looked at clicks by each of these groups. People living in Austin were the least likely to click the ad. We saw the greatest click thru from consumers out of market looking for information and shopping home builders in Austin.

PERFORMANCE:

We’ve looked at the Google Analytics of several builders and have a predictable level of performance across each of our advertising channels. This allows us to keep pricing competitive and ensure we’re delivering meaningful value to our clients. With Ad Networks, a builder might receive a low CPC but we typically see much higher bounce rates and fewer meaningful actions. So while you might save on the front end it could cost you more on the backend where it really counts. Obviously at some point the economics will work but it’s important to differentiate quantity vs. quality.

These factors are some of the reasons many exchanges have reverted to focusing on retargeting which shows significantly stronger conversion vs. blanketing a host of sites with ads. The metrics simply didn’t warrant continuation and they’ve had to create solutions that provide better value. Even with the impact of Retargeting for the online exchanges we’ve identified a whole set of nuances specific to that medium.

Exchanges do have their place and may make sense for specific campaigns or clients that can afford continued active management. However, I think most builders who try to “save” by taking their advertising in house often lose out in reach and performance.

For information regarding online marketing and a review of your current digital marketing plan please contact us at info@thebdx.com.

Thane Tennison is the Senior Advertising Manager for the BDX and manages hundreds of home builder brands across a network of over a dozen real estate websites.

As the BDX continues to expand its advertising solutions we’ve noticed many builders do not have a privacy policy clearly accessible on their website. This is an important if not often overlooked feature for a professional website.

As the BDX continues to expand its advertising solutions we’ve noticed many builders do not have a privacy policy clearly accessible on their website. This is an important if not often overlooked feature for a professional website.