By Jamie Lintner, BDX Advertising Manager

By Jamie Lintner, BDX Advertising Manager

IP Targeting vs. Geo Targeting. This war has been waged in the online space since the inception of banner advertising. On one hand you have the publishers who stand by IP targeting, the idea that targeting the unique location that a user is browsing from increases the relevancy of the ad itself. On the other you have targeted ads based off of the search parameters of that same user. Both have extreme merit depending on the type of product being advertised.

In the home building vertical, this targeting can have a significant impact on performance. Consumers moving from Austin to San Francisco want to see homes and builders in San Francisco. We pulled the stats below to help quantify this lift and better understand the impact of ONLY running an IP targeted campaign via Google or other exchange.

To calculate these numbers, I pulled a 3 month sample that included 15 of BDX’s largest advertisers from all parts of the country. I then subdivided traffic into 3 unique performance buckets of data; impressions served in market (Consumers in Austin looking for Austin Homes), targeted delivery to the state (Consumers living in Texas looking for Austin Homes), and targeted delivery to users out of state (isolating people with a desire to relocate across state lines). No data-group contains any duplicate areas.

I assumed that performance would be equivalent for all areas regardless of the geography where the ad was served. In reality, performance is far stronger for users shopping for a home in a different state. As a home builder your ad is 42% more likely to be clicked on by a user out of state than by one in-state, meaning that an IP targeting campaign completely ignores the group of users that is statistically far more likely to engage with your brand.

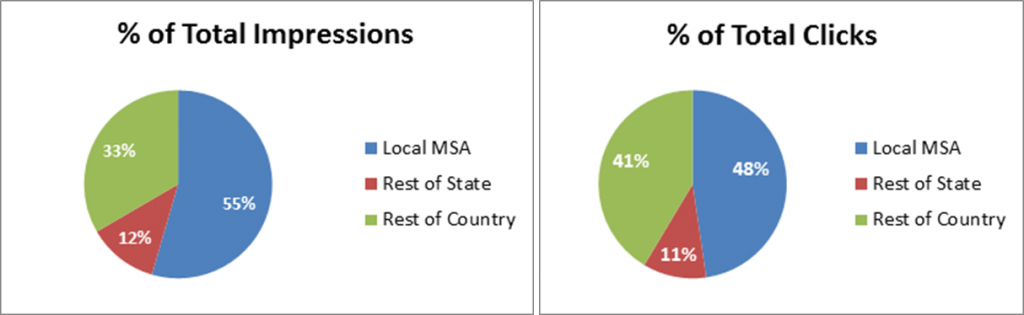

On average, impressions to the local geo-area (bucket #1) delivered 55% of total delivery and 47% of total clicks. Users in the remainder of the state (bucket #2) were served 12% of total impressions and represented 11% of all clicks. Lastly, users across the nation were served 33% of all geo-targeted impressions but they represented an astonishing 41% of total clicks.

My best guess as to why there are different levels of performance between data groups is the vast difference in shopping urgency. Home shoppers already in the market will casually browse for a new home. Maybe they have strong intentions to move in the coming months or maybe they’re like my wife; just looking around for that perfect home in ten years. By comparison, out of state users appear to have a much stronger sense of urgency when shopping for a home, potentially due to a job relocation or change in lifestyle.

I’m a perfect case study for an out of state shopper. My wife recently took an out of state job and we had two weeks to find a home. Naturally we reached out to countless communities, apartment complexes, and anyone with a bedroom. Our search was more intentful and motivated than in-state shoppers who weren’t in such dire straits. What home builder wouldn’t dream of such a client?

Is your ad campaign effectively being tailored to the right audience through other online sources? At BDX we are constantly striving to improve all ad campaigns for home builders and provide guidance on where your ads will perform best. To learn more about the different types of campaign targeting, please see our previous blog post, Getting the Most from your Exchange Network. For information on starting your own ad campaign contact Info@theBDX.com.